by Dr Fiona Pathiraja, Managing Partner.

Diversity is a hot topic in VC, and one that is seemingly on everyone’s mind. Yet in my own experience as a female investor of colour investing across Europe and running my own firm, I see very few female or ethnic minority VC partners writing cheques across Europe.

Crista Galli Ventures invests heavily in the deep tech space in healthcare. In these deals, I am very often the only female, and only non-white person, on the cap table. Even in 2021, this has led to awkward, and unacceptable, conversations. Within the last twelve months, male coinvestors have asked me, “who is writing your cheques for you?”… I will be writing my own cheque, thank you very much.

I’ve noticed low numbers of female, ethnic minority or LGBTQ+ founders securing VC funding compared to their straight, white, male counterparts. Anecdotally, female founders of femtech companies have sighed with relief to see me in a healthtech pitch meeting, as they realise they can say the word ‘vagina’ without a raised eyebrow or a snigger. My anecdotal observations are mirrored by evidence in Atomico’s state of European Tech report, published this week.

European VC needs to back more women and diverse teams.

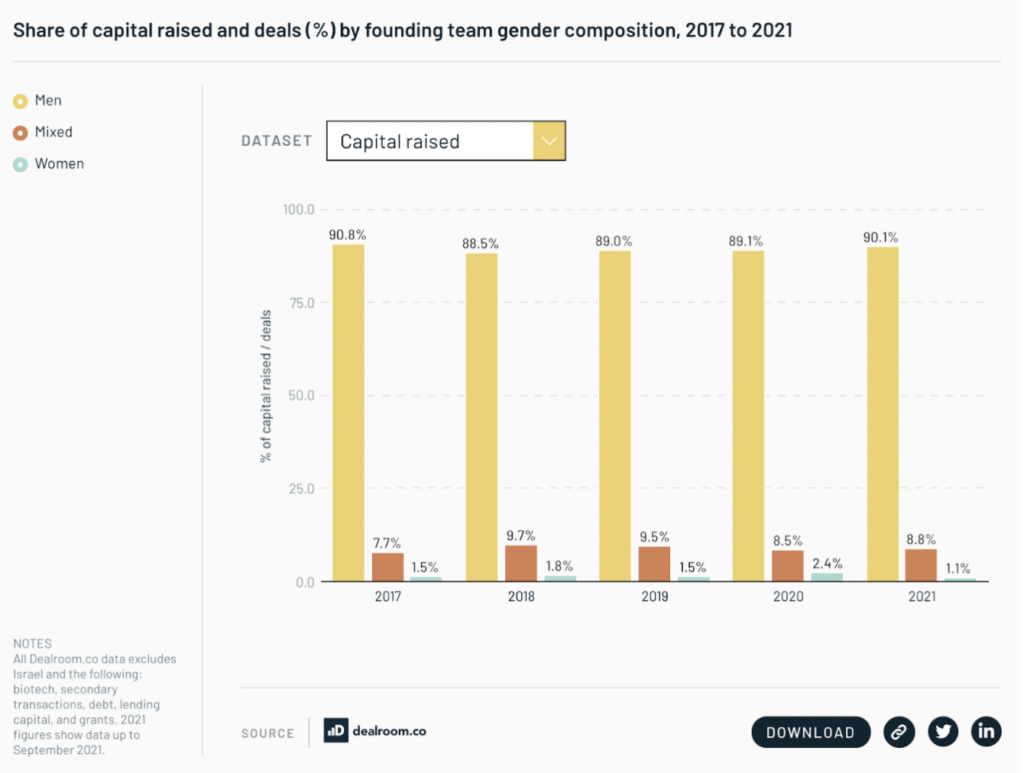

In 2021, European VC investment crossed the $100 billion in annual funding for the first time. The ecosystem’s total enterprise value of all European tech companies is estimated at $3 TRILLION. Female founders get a paltry 1.1% of all capital raised which is far less than last year where they captured 2.4%. The gender gap is real and alarmingly, it is widening. Mixed gender founding teams take 8.8% of all total capital. Both sides of the founder-investor table lack gender diversity with only 12% of European VC GPs and MDs being female. If you’re an ethnic minority founder, the stats are also startling. Whilst ethnic minority founded companies take 3% of seed stage funding, they take an even more miniscule 1% of funding at later stage VC.

As I have evolved as an investor, I have turned the mirror onto myself and the work we do at Crista Galli Ventures. Today, I refuse to back startups where women are an after-thought, where diversity isn’t central to culture from an early stage. I’m also putting capital to work in the wider ecosystem by angel investing in many female-founded startups and being an LP in funds that are working to improve the ecosystem e.g. January Ventures. As a female investor of colour, I am keen to help build a future that I want to be part of.

What are we doing at Crista Galli Ventures?

In 2019, I noticed that women, people of colour or those from an LGBTQ+ background were not getting funding at the pre-seed stage compared to their white, male, straight counterparts.

So we started Crista Galli LABS, our pre-seed arm, to back traditionally under-represented founders at the earliest stage. Our LABS programme invests in pre-seed startups where at least one of the founding team is from a traditionally under-represented group. Since 2019, our LABS cohort have enjoyed lots of success e.g. Charco Neurotech raising a huge $10M seed round, Pear Bio being accepted into Soft Bank’s Emerge accelerator and Vitrue Health closing a $2M seed round with BUPA on their client roster. The latest investment into Crista Galli LABS is Oviavo from Germany. Founded by a mixed gender team of Jenny Saft (incidentally one of this year’s Atomico Angels) and Tobias Kaufhold, Oviavo are building a solution for fertility and family forming benefits for employees.

There are various organisations who are putting capital to work in ways to improve diversity and influence social change. The Gaingels network connects a global network of LGBT+ and ally investors to founders whilst improving diversity in startups. Google’s black founders fund invests into early-stage companies led by black founders via a $5M fund. Auxxo in Germany has raised a $15M fund to back startups with at least one female founder.

Recognising the disparity of funding between traditional and non-traditional founders is important and talking about it is also important. However, those with a platform and capital must put their money where their mouths are. Change doesn’t come easily or quickly and the above are all just a start. There is a long way to go.

Read the Atomico State of European Tech report here.

by Dr Fiona Pathiraja, Managing Partner.